March 6, 2007: Momentum / Value / Risk

[Needs JavaScript enabled for hover tooltips & clickability]

On violent corrections and their aftermaths

After almost 8 months of uninterrupted "up-up and away" movement in the markets the inevitable counter movement has arrived. Chinese markets which led the way up "mini-crashed" by almost 10% in a single day (Feb 27, 2007) anything having to do with scary themes such as: "South East Asia" (Singapore, Malaysia), or "real estate" (including commercial REIT ETFs such as VNQ) or "financials" (even those with no almost no exposure to the sub-prime markets) followed sharply down. No part of the world was spared. It was a classic picture of a somewhat unreasonably widespread panic.A period of straight 8 months of upward move is very unusual. That the correction was pretty violent, shouldn't surprise anyone who has been watching the behavior of the markets for some time. Big movements in either direction, tend to be followed by counter movements.

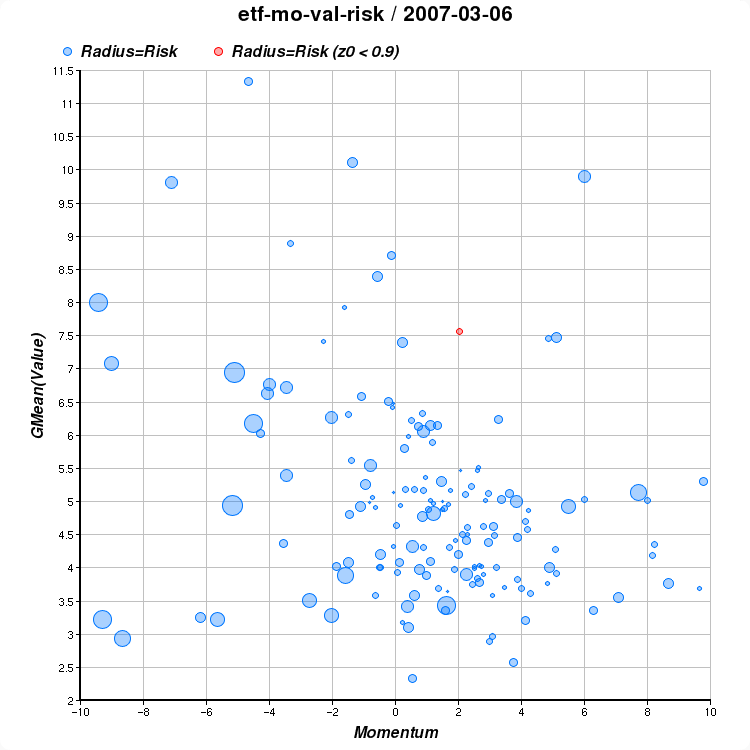

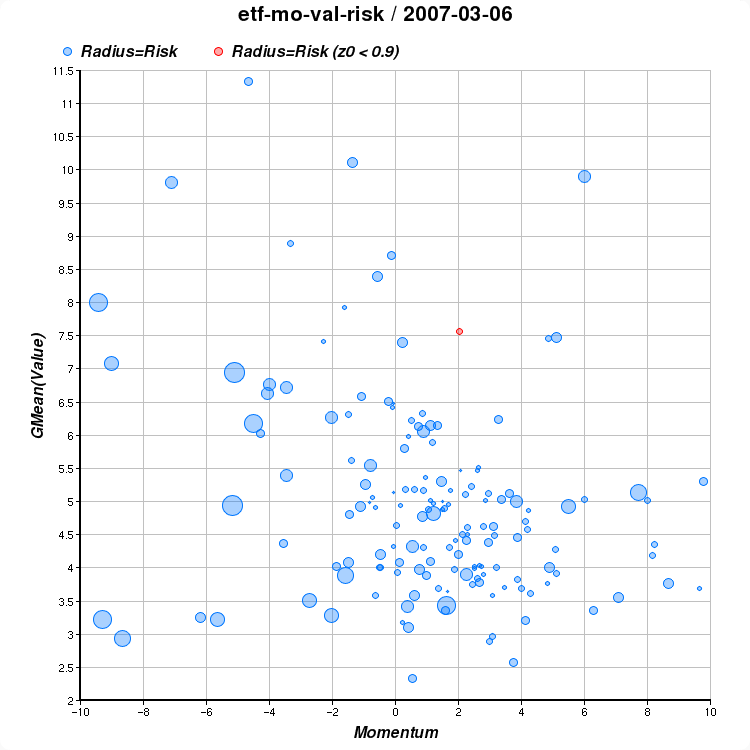

As you can see in the above chart, defensive ETFs like Utilities and Telecom are now dominating the right (strongest momentum) section This is a sign of great fear, which is actually bullish.

The pundits and talking heads have been arguing on CNBC and elsewhere on whether this is the start of a new trend or just a temporary setback.

The bear case relies on:

- The overheating of the chinese markets, markets were up over 100% last year there. Valuations are too high. The speculative bubble there is obvious. I actually agree on this. I avoid the Chinese ETFs.

- The subprime lending market is starting to show significant stress Many recent US homeowners assumed too much risk, took mortgages above their means. As their mortage rates adjust they can't pay.

- A sharp inventory correction in the US and slowdown in GDP growth

- A continuing slow down in earnings growth

- Oil prices are again way up from their lows. Just like in May 2006.

The bull case relies on:

- Stocks are still historically cheap. As cheap as they were in 1996-1997 before the big internet bubble started pulling the markets sharply up.

- Investors still haven't gotten over the last bear market, a lot of money is still on the sidelines; not committed to the market.

- Private equity activity at a record - companies are too valuable and are being taken private

- Stock buy backs are at a record high - there's a scarcity of shares

- The earnings-yield (inverted PE including accounting for dividends) on the S&P500 is way above the yield on the long term bond.

So who is right?

Is there anything we can do to try and predict our odds? Where are the markets going? What are the best ETFs to be invested in going forward?At times like this, one of the things I learned to do is to listen to Ken Fisher. Ken has one of the best records on getting the big picture right. You can find two of his recent articles here (may require free registration):

I'm not sure whether to buy the housing boom argument (may be true in the Bay Area, where Google, Apple, and other booming companies keep hiring but not nationally), but I definitely agree with Ken's general bull case. I've seen a few bear markets, they never start with such bang and with so much scary talk as we experienced in the past few days. They also don't start when valuations and prospects are reasonable. Also, the up day following the biggest drop tells me there are enough buyers stepping in to take advantage of the opportunity. I'm betting on a short lived correction.As we learned in the last May-June 2006 correction, this might well be an opportunity to buy what we wanted to buy anyway, just cheaper. To get more specific answers we turn to the raw data.

A roadmap

The first question is, assuming this correction is short lived, where are the markets going in the next few months?Let's look back at the correction which started on May 10, 2006. The current correction was much sharper (so far) which tells me it will be even more short lived. Prolonged drops tend to be spread out in time, sharp corrections rebound faster. What happened after the bulk of the drop was over by the end of May 2006? A couple of scripts have the answer:

$ etf-rank -D 20060530 -O fret1m | average 1.58972 $ etf-rank -D 20060530 -O fret3m | average 4.37444What this says is that starting from May 30, 2006 (not the bottom but well into the correction), ETFs on average went up sharply. How sharply? The rebound following the bulk of the last summer correction was: future 1-month average ETF return from that point onward was 1.58% and the future 3-month average ETF return was 4.37%.The top 50 ETFs of course, fared even better with a 6.86% rebound:

$ etf-rank -D 20060530 -O fret3m | sort -n | tail -50 | average 6.8636

Keep overweighting value

But with the tools and the data we have, we can do better. Which ETFs went up the most following the May-June 2006 correction?Let's look at valuations. Specifically: P/E ratios.

$ etf-rank -D 20060530 -O pe,fret1m | correlation C(0,1): -0.34820156 $ etf-rank -D 20060530 -O pe,fret3m | correlation C(0,1): -0.46623528We can see that there was a negative correlation between the future returns of ETFs and their average PEs. In other words: high-PE stocks faired worse than low PE (value) stocks. Things might always be different, but the similarities between the two corrections are just too big to ignore and I expect this to repeat. To confirm I look for days where markets go up following a big drop to see which ETFs are doing better in the early stages of returning to normalcy. The best performing so far are the usual suspects.

Keeping the correction in perspective

To keep this correction in perspective you may want to peek at a recent article by Birinyi associates showing all 5% or more declines in the present bull-run. There were 6 of them in 4.5 years, or about 1.33 corrections/year. What is remarkable is how regular they look: they are spaced pretty evenly 6-12 months apart.The conclusion from all this is stay the course, don't panic. If you have the guts, now may be the best time to put some more money in solid value ETFs from around the world. This includes ETFs like the Wisdom Tree international ETFs (DIM, DOO, DLS, DFE), The Vanguard low cost Mid-Cap Value (VOE) and General Value (VTV). The Rydex deep value ETFs (RFV, RZV), the countries that still have reasonable valuations, (Germany: EWG, Belgium: EWK, Korea: EWY) or the broader European ETFs (EFV, VGK).

The ETF Screen

Enclosed is my recent favorite ETF screen favoring moderate momentum, value, and averting risk. [Some couutries are missing due to my data feed dropping PS and PB ratios on some of the international BGI ETFs.]Good luck,

-- ariel[note: dated material. March 6, 2007] Momentum, Value, Risk: 50 out of about 290 ETFs, best to good order.

Using mmvr ranking method on 20070306 Rank Score Ticker Full Name ---- ------ ------ ------------------------------------------- 1 2.2242 TTH Telecom HOLDRs 2 2.0862 VAW Vanguard Materials VIPERs 3 2.0073 VPU Vanguard Utilities VIPERs 4 1.9425 EWG iShares MSCI Germany Index 5 1.9350 XLB Materials Select Sector SPDR 6 1.8639 VOX Vanguard Telecom Services VIPERs 7 1.7446 UTH Utilities HOLDRs 8 1.7245 RFV Rydex S&P Midcap 400 Pure Value 9 1.6740 DNL WisdomTree Japan High-Yielding Equity 10 1.6543 IDU iShares Dow Jones US Utilities 11 1.6392 XLU Utilities Select Sector SPDR 12 1.6124 IXP iShares S&P Global Telecommunications 13 1.6032 IWS iShares Russell Midcap Value Index 14 1.5476 JKI iShares Morningstar Mid Value Index 15 1.5474 VPL Vanguard Pacific Stock VIPERs 16 1.5446 VGK Vanguard European Stock VIPERs 17 1.5219 PWP PowerShares Dynamic Mid Cap Value 18 1.4926 ADRU BLDRS Europe 100 ADR Index 19 1.4914 EFV iShares MSCI EAFE Value Index 20 1.4811 IYZ iShares Dow Jones US Telecom 21 1.4764 PGJ PowerShares Gldn Dragon Halter USX China 22 1.4532 EZU iShares MSCI EMU Index 23 1.4221 EWK iShares MSCI Belgium Index 24 1.4106 EWM iShares MSCI Malaysia Index 25 1.4069 DLS WisdomTree Intl SmallCap Dividend 26 1.3962 EWS iShares MSCI Singapore Index 27 1.3057 DFE WisdomTree Europe SmallCap Dividend 28 1.3013 EWP iShares MSCI Spain Index 29 1.2963 EWA iShares MSCI Australia Index 30 1.2941 VTV Vanguard Value VIPERs 31 1.2935 PPA PowerShares Aerospace & Defense 32 1.2671 ADRD BLDRS Developed Markets 100 ADR Index 33 1.2647 EPP iShares MSCI Pacific ex-Japan 34 1.2498 VCR Vanguard Consumer Discretionary VIPERs 35 1.2428 DNH WisdomTree Pacific ex-Japan Hi-Yld Eq 36 1.2331 EWW iShares MSCI Mexico Index 37 1.2031 EFA iShares MSCI EAFE Index 38 1.1887 PUI PowerShares Dynamic Utilities 39 1.1864 IYM iShares Dow Jones US Basic Materials 40 1.1623 PMR PowerShares Dynamic Retail 41 1.1479 FXI iShares FTSE/Xinhua China 25 Index 42 1.1390 RPV Rydex S&P 500 Pure Value 43 1.1385 FEZ streetTRACKS Dow Jones Euro STOXX 50 44 1.1229 SDY SPDR Dividend 45 1.0614 EWO iShares MSCI Austria Index 46 1.0543 IWD iShares Russell 1000 Value Index 47 1.0528 PRF PowerShares FTSE RAFI US 1000 48 1.0369 DVY iShares Dow Jones Select Dividend Index 49 1.0350 XLY Consumer Discretionary SPDR 50 1.0303 EWQ iShares MSCI France Index

References: