Nov 22, 2008: Countries above their October lows

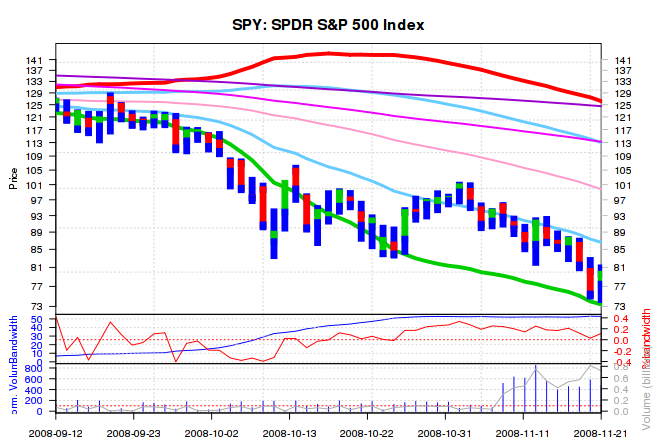

Friday's rally notwithstanding, the S&P 500 ETF (SPY) is now well below its October lows. Many investors are now predicting Dow at 6000. Citigroup and GM in bankrupcy, and no end to this crisis in sight. Intel, a virtual monopoly of a very lucrative growth market, extremely rich in cash, and one I consider of the safest to invest in, was trading on Thursday at a single digit PE.

Are there any countries in the world which are holding up better and might be the leaders on the eventual way up when we finally bottom? Japan and China seem to be in a sweet spot right now. These are two economies that are:

- under-leveraged (running large trade and goverment surpluses)

- benefitting greatly from falling commodity prices

- and that have dropped significantly from their long term tops.

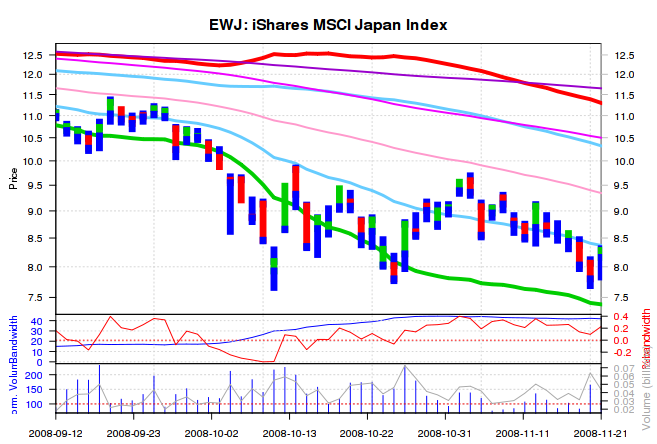

China's market drop is dwarfing the US 50% drop at over 80% from the top. Japan is now lower than after it own long bubble burst way back in 1989.

Yes, Japan has lost not one decade, but two full decades. With interest rates there hovering around record lows, home mortgage loans in Japan start around 1 percent to 2 percent for variable rates, and about 3 percent for fixed rates, and the terms can be as long as 35 years. The average yield on rental property is around 6 percent. Seems like the Japanese real-estate market has found a solid bottom.

Not surprisingly, these two countries are now among the few which have held and not broken their prior October lows. Below are some interesting charts for the brave to consider.

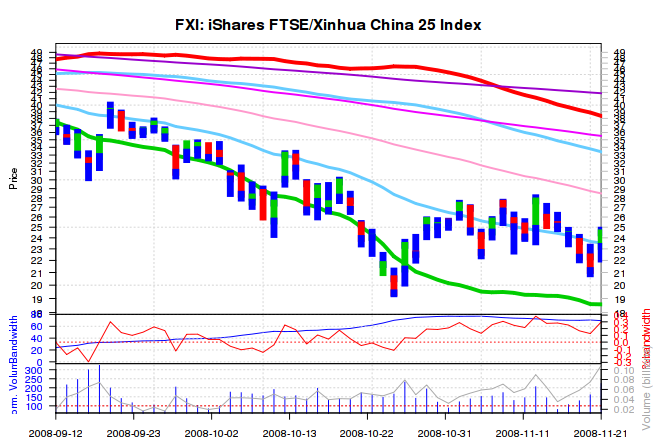

China

The strongest of the bunch. Growth has dramatically slowed, but there's still significant growth to show vs the developed countries.

Japan

Two decades lost, finding a long term support?

Japanese small caps are even stronger:

Mexico

Something to do with Oil finally finding some support?

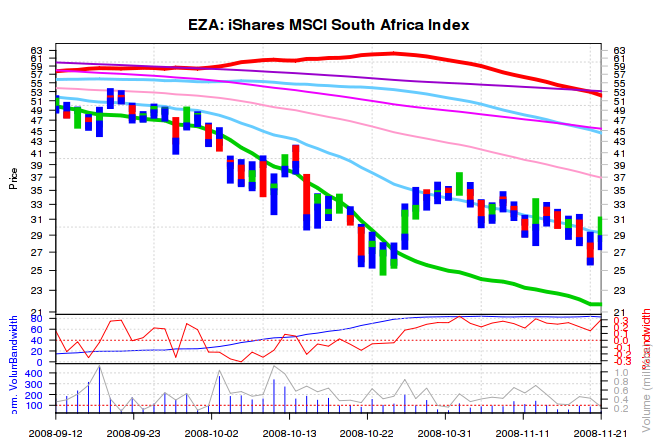

South Africa

Something to do with gold and hedging against catastrophies?

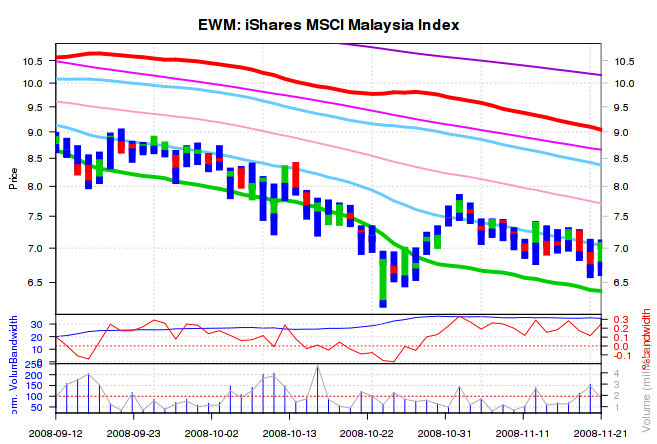

Malaysia

As always, this isn't intended as investment advice. It merely reflects my own thinking and actions at the time of writing. In the immortal words of John Maynard Keynes "When the facts change, I change my mind. What do you do, sir?"Every investor should make up their own decisions based on their risk tolerance and understanding.

Any feedback is welcome.

-- ariel