Sep 18, 2008: Getting fully invested

Highlights:Intro Extreme reversal Looking ahead The price of learning

What happened in the past 2 days comes as close as I've ever seen to a bona-fide long-term bottom. I'm getting fully invested.Is this another intermediate-term bottom like the ones we saw and called in Jan, March, and July, or a more longer-term one? Nothing is ever guaranteed, but this bottom sure looks significant.

As the moose likes to say: This is free advice, it is worth (only) what you make of it.

Extreme Reversal

So many are the signs of a very significant bottom here that I can fill many pages with data supporting it. Instead I'll try to be brief, and mention just a few items:

- VIX, the volatility index has hit a 6-years record of 42.16 during the trading session today. Looking back for 18 years I was able to find only 15 instances, clustered in 3 groups, of the VIX going over 42. These 3 clusters being:

Check the charts: all 3 marked major intermediate (2001) and long term (1998, 2002) bottoms.

- Sep-Oct 1998: Russia's Default, LTCM implosion

- Sep 2001: The September 11 events

- Jul-Oct 2002: Last stage of the dot com bubble bursting, Enron, MCI WorldCom, et al. implosions.

VIX 18+ years: 15 spikes over 42: Date Open High Low Close 2002-08-06 42.03 42.03 42.03 42.03 2002-10-09 42.13 42.13 42.13 42.13 2002-10-07 42.64 42.64 42.64 42.64 2001-09-21 42.66 42.66 42.66 42.66 1998-10-05 42.81 42.81 42.81 42.81 1998-09-04 43.31 43.31 43.31 43.31 1998-10-01 43.48 43.48 43.48 43.48 1998-10-07 43.51 43.51 43.51 43.51 1998-09-11 43.74 43.74 43.74 43.74 2001-09-20 43.74 43.74 43.74 43.74 1998-08-31 44.28 44.28 44.28 44.28 2002-07-23 44.92 44.92 44.92 44.92 2002-08-05 45.08 45.08 45.08 45.08 1998-09-10 45.29 45.29 45.29 45.29 1998-10-08 45.74 45.74 45.74 45.74

- "Financials" are no longer one group. While the overly leveraged broker-dealers (LEH, MER, MS, GS) are struggling, others such as Wells Fargo, BofA, JPM, are emerging as winners. These winners held extremely well during the recent bottom. It doesn't look like they'll be retesting their March bottoms, even when/if the weaker ones break new lows.

- If you were waiting for bigger financial institutions to fail, you got them. The GSEs (Freddie and Fannie) and AIG are as big as they get (100s of billions). LEH is a tiny fish in comparison. What this means is that while we may see some more failures, most of the bad news now seems behind. Even if the economy still has a way to go down, remember that markets tend to bottom-out about 2 quarters before the economy turns the corner.

- Commodities have made their (speculative) long-term top. If you've made 11% on Gold's spike up, I would advise to sell now, all the signs I see, say inflation is dropping, not rising.

- Yields on short-term CDs were negative yesterday (thanks Moty). Investors were so panicked, that they actually sold solid stocks with great earnings and balance sheets, and even better forward earnings prospects, and paid more than $1 for $1 of "safety". What this tells me is that it is time to leave at least some of the safe-heavens behind and dip into good stocks and ETFs.

- Persistent Positive divergences keep being established in US markets.

- Most significantly: governments have stepped in, making it clear that they will do whatever it takes to avert a crisis. Including even changing the rules of the game while the game is being played (again, thanks Moty for the notes). Two articles:

- Short-Selling Crackdown Extends to New York, London (Bloomberg)

- Paulson, Bernanke Push New Proposal to Cleanse Balance Sheets (Bloomberg)

- The old mmvr (Momentum, Value, Risk) strategy which I first wrote about almost 2 years ago, and which I abandoned in 2007, when 'value' ceased to be a market preference, is starting to shine again. MMVR is now agreeing with the few long ETFs that are among the top performing in recent months: IYT, XBI, KRE, HHK, HHV, IWN.

- Sep 19, 2008 updates:

- Carl Swenlin at decision point.com, one of the most highly regarded market technicians now sees a significant bottom as well.

- Sep 19th was not a day to buy. The new short regulations caused an unprecedented short squeeze. IYG (the US Financial Services ETF) was up 20% (!) in morning trading. Never chase these extreme short term moves as they always revert to the mean. I'd wait for some consolidation before building positions.

- The ban on shorts has a time limit, will we see a renewed extreme shorting of financials when it ends? I have no idea, but volatility will likely continue to be much higher than normal. What I do know is that during times of extreme short-term volatility, the best action is not really to "do nothing", but to take positions against emotions, i.e. against the short term movements: buy on the sharp daily drops, sell on sharp daily spikes. I've done this with very volatile options and found it to work exceptionally well.

Looking ahead

How far and how long will the next up-leg take us. Hard to say for certain, but I think this move should be significant. All the forces seem to point at the same direction: commodities are long-term imploding, inflation is subsiding, the dollar is strengthening, corporate profits in the US at least, are bottoming out (thanks to financials having written-off most of their losses, and to sharply declining fixed costs). The rest of the world, including countries, which not long ago were aggressively tightening rates to fight inflation (see China), are finally getting the reverse message and are beginning to lower rates. Lowered cost-structures, due to declining yields, commodity prices and inflation, are an extremely potent mix boding well for stocks. PEs should be shrinking dramatically soon, which means stock prices will have to follow up.

Then, there's help from unexpected places. I try to do a lot of legwork trying to find the best data-driven bloggers; those with the good actual records, so you don't have to. I recently discovered an excellent site: Steve LeCompte's CXO Advisory This is a rare treasure combining data-driven analysis, modelling, and great skepticism. Every hypothesis is checked and either verified or refuted statistically. Most importantly, Steve have developed three models predicting the S&500 for a year ahead, based on corporate earnings, inflation, and fixed-income yields. A combo of the 3 models now projects the S&500 to about 1550 by September 2009. (chart below). Given the accuracy of these models in the past, and Steve's excellent other work, I'll be reading Steve LeCompte on a regular basis.

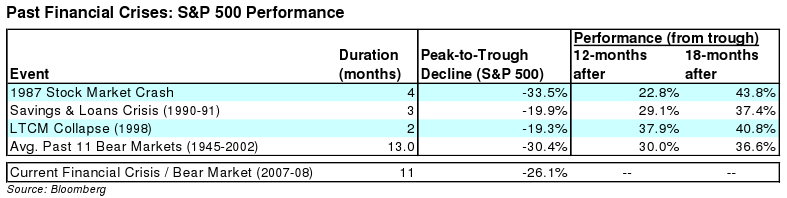

For more perspective, here is a comparison of past financial crises to the current crisis:

The price of learning

At junctions like this, it may be good to look back and try to summarize the good and bad calls I made during this bear market. Even if it may have more time to run.I have been both wrong and right during the past 12 months. As my hope has always been to learn and improve over time, I consider all my blunders precious lessons, I literally paid dearly for them, but I believe these errors planted the seeds for a lower error rate in the future:

Being Right:

- Calling this bear market early enough, Not being fooled by the perma-bulls, during the first small bear-market rally (Dec 2007). Actually profiting from the bear using inverse ETFs at a pretty early stage (Short Russell 2000 Value) and late stages (short Europe, China, and Emerging Markets).

- Getting one intermediate top right (May 2008)

- Being mostly right on the past 3 intermediate bottoms:

- January 22 (Societe Generale, arguably one day early, based on going over my emails. I regret I procrastinated about 10 days to publish a public article)

- March 10-19 (The Bear Stearns implosion, spot on), See the Market Update section 3 days after Bear Stearns imploded.

- July 15 (3 days early) using my intermediate term, multi mean-reversion meta-model.

- Profiting from the energy/materials strength. Note: even though we're now short-term oversold on these, and are due for a nice bounce, I don't recommend holding commodities/energy anymore for the long term. The ~5 year bubble, in my view, had burst. I've never seen a case of a 5-year bubble bursting and its chart marking a long term top, and then coming back.

- Figuring out some market-neutral pair-trades based on the "deleveraging" theme: mid-cap growth outperforms large cap value. These pair-trades worked very well during this bear-market. Note: this trade is no longer valid or recommended: value (although not large-cap yet) is now clearly outperforming.

Being Wrong:

- Starting to get long (albeit into the more-or-less correct sectors) on the last decent to the July 15 bottom somewhat early.

- Holding on to my longs for too long during all rallies from the intermediate bottoms. Even though it was clear to me the Bear market is still in force. Ever the optimist, I pushed my luck for too long on my longs. The precious lesson here is really simple: during bear-markets, shorts dominate and win, don't push you luck on the rallies, realize your long profits early, and hedge with some broad shorts.

- Being way too early trying to dip into financials via LEAPS. My only two profitable positions are WFC (Wells Fargo, +104.88% since my small buy. I'm holding for some more), and ETFC which I started too high, but recovered using short-term trading (I played the 0.20-0.30 fluctuations, selling when it spiked, bought-back when it dipped) a few times. I closed 3 other LEAPs positions at a loss, and am holding 2 more losing positions on Intel and Goldman (big mistake) -- Now is definitely not the time to sell them. Fortunately, this was a small bet overall.

- Not realizing the very large (20-50%) short-term gains on all the LEAPs I bought. For example, I was up 50% on my Intel LEAPS shortly after my buy, and foolishly held on to it. The result was that I gave up all the gain and then some. What I've learned here is simple: near the money options are extremely volatile in the short-term, the better way to play them, is buy on extreme dips, and sell quickly on the rebound. LEAPs may (or may be not) long term plays, what they sure are, is excellent short term plays.

- Still TBD, but probably somewhat wrong: estimating that XLF (financial sector ETF) would bottom around 14.04. History is a great guide, except when a new unforeseen factor comes in. What I didn't anticipate is the force of government intervention. I now believe that XLF has bottomed around 17 back in March with the Bear Stearns collapse.

Full Disclosure:

Getting 100% invested for now. Deploying all cash (and LT treasuries) back into US stocks. Long Dow Transports, US Small Cap Value, Some Biotech and healthcare, and possibly some select, stronger financials. I consider shorts extremely toxic at this time. I've closed my EEV and EFU positions, a bit early since they spiked way too high for my taste, but even so, they helped my portfolio a lot. If I had any shorts left, I would have covered yesterday. Fortunately, I didn't have to. SCC is the only inverse ETF I can think of right now, that still trades reasonably low and may hit some more bottoms on very weak consumer demand (as expected from a prolonged weak economy, high unemployment, bankruptcies, and erosion of real wage growth). But even for SCC, now is not the time. I believe shorts (and put holders) will be squeezed very hard in the coming month.IMHO:

The moose will have to switch out of long-term treasuries (TLT) soon. I believe they have peaked yesterday. The problem with following momentum is that one always lags. Whenever events like the past two days occur, major reversals ensue, and delayed trend-following methods lose.

Sept 21, 2008 update:

I got an unusual number of email responses to this piece. Almost all advise me to exercise caution. Let me clarify:

- No I don't think that home prices have hit bottom. Inventories are still way too high, credit is hard to come by, and reversion to the LT mean, on all parameters: affordability, inventories, rent vs buy prices, is still in force. This piece is not about home prices.

- No, I don't think the economy is out of the woods, far from it, in fact. There's a lot more pain to come in the coming months.

- My move is mostly short term: I'm essentially being a short term contrarian. I think the S&P500 at 1150 was a good short-term buy, and at 1300 it is probably a sell right now. The thing is that these 100-150 point moves now happen every few weeks instead of many months, so I'm trying to benefit from them.

- I think there are two ways to do well in this market, it depends on your personal style/preferences:

- If you don't know what to do and prefer to be both as passive and as careful/conservative as possible, you cannot go much wrong by simply following DecisionMoose.com The moose was in Gold, then in Cash for a long time, and he recently moved into long-term treasuries. He moves about 4 times/year on average, and only does so when both the long term trend (45 week) AND the intermediate term trend (9 week) agree with his own view. His 12 year documented record is exceptional. If there's a strong case against buy and hold, the moose is it.

- If you like to be active, this market is heaven on earth. There's a good reason why Renaissance Medallion (James Simons) managed to make ~85% in the past 12 months. The technique is: watch the long term trends (and realize we are in a bad economy) but Buy/Sell against the short term movements and do it often.

Acknowledgements:

to those who keep emailing me, especially to Moty, Adi, Adrian, Aaron, Lee, Herman, Ilan, Robert, Peter, Anand, Kostas, & Gilbert. Thanks for everything you've taught me, and please keep writing your thougths.As always, any feedback is welcome.

-- ariel